Written By Curtis Cusinato, Marshall Eidinger and Ashley White

The Canadian M&A landscape is one of reserved optimism as 2022 comes to a close and we look ahead to a new year. Despite the uncertainty in the marketplace, Canada remains home to attractive assets and dynamic dealmakers. We expect M&A transactions in 2023 to see impressive activity in sectors such as technology and software, renewable and alternate sources of energy (particularly wind, solar, hydrogen and energy storage), battery metals in the mining sector, healthcare and agribusiness. Canada's mid-market remains resilient and we expect this to continue in 2023, albeit with a more cautious approach.

Trends in Canadian M&A transactions to watch for in early 2023 include:

- an uptick in going private transactions across multiple sectors and market caps;

- continued interest by private equity in the Canadian mid-market, with greater scrutiny of acquisition targets and longer completion timelines;

- the potential for more shareholder activism; and

- an increase in distressed M&A transactions.

Canadian Q4 and Full-Year 2022 M&A Deal Activity

All numbers are according to Bloomberg data (announced, completed or pending deals, excluding those that have been terminated or withdrawn) as of December 28, 2022, in U.S. dollars.

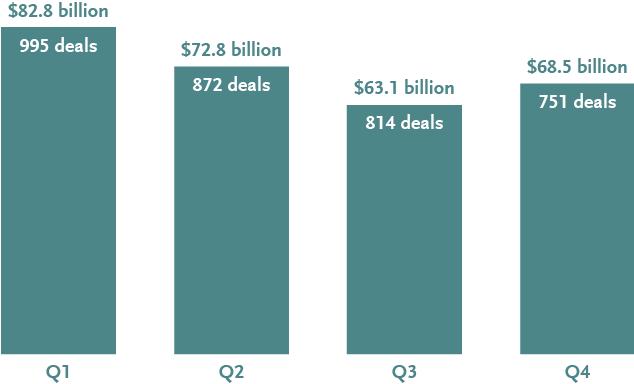

M&A volume was up in the fourth quarter of 2022 to $68.5 billion, from $63.1 billion in Q3. Full-year 2022 saw total M&A volume of $287.2 billion on 3,432 deals. Q1 was the most active while deal count declined incrementally each quarter this year.

November was the busiest month this year in M&A volume at $52.5 billion. It was preceded and followed by the least active months—with $7.6 billion in October and $8.3 billion in December.

Canadian M&A by Sector in 2022

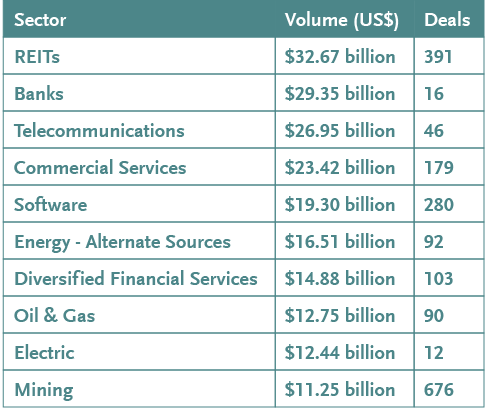

REITs led the way in Canadian M&A volume by sector with $32.67 billion in deals. Banks were next, with some of the largest deals of 2022. When combined, the banking and diversified financial services sectors accounted for $44.23 billion in activity—one of the busiest years for M&A activity in the Canadian financial services sector in recent memory, with several high profile transactions.

Software was in fifth place, dominated by $13 billion in applications software and $5.7 billion in enterprise software. There was more volume in alternate sources of energy than in oil & gas—and taken together the sectors totalled $29.26 billion in deals. Mining saw over $11 billion in volume with the highest deal count in 2022.

M&A Opportunities in Canada by Sector in 2022 and Expectations for 2023

- Mining: We anticipate the potential for meaningful M&A activity in the mining sector over the next twelve months. While the industry remains subject to general macroeconomic headwinds from inflation and higher interest rates, demand for critical minerals—along with base metal components needed to feed the growing interest in decarbonization and electrification in sectors such as the auto industry (which is racing to meet ambitious EV production goals around the world)—remains robust. Higher commodity prices could also serve as a further catalyst for strategic, opportunistic or growth-driven M&A. In 2022, Q4 saw the most volume in mining and deal count was steady throughout the year.

- Energy: M&A activity in the traditional oil & gas sector in 2022 was somewhat cautious, driven primarily by companies looking to expand their core assets (with E&P companies selling off non-core assets in their upstream portfolios), building scale to achieve synergies and diversifying to natural gas (including biofuels). The rapid appreciation of commodity prices in the first half of 2022 contributed to a stall in oil & gas M&A activity, which saw some increased activity once prices stabilized. However, the overall instability of commodity prices over the course of the year, among other issues, generally left M&A activity muted from prior years. In 2023, we expect to see more investors and companies in Canada pursuing partnerships and joint ventures to build competitive advantage (including meaningful equity investments by Indigenous communities) and a continued focus on achieving ESG targets, in each case through strategic acquisitions and equity raises to advance development projects.

- Alternate energy: M&A activity in the alternate energy sector has been growing and 2022 saw an abundance of international deal making by Canadian investors, principally focused on clean grid/transmission, solar, wind and hydro. The demand for alternate energy sources is expected to generate more deal activity in 2023 across industries. We expect this, coupled with decarbonization targets by governments in Canada and globally, will see companies continue to diversify their portfolios and seek investment opportunities in high-growth renewable assets in 2023.

- Technology: Notwithstanding the recent well-publicized decreases in technology company valuations, in 2022, the tech sector demonstrated robust M&A activity with the software sector alone recording US$19.3 billion in deal value on 280 deals. The sector remains ripe for future M&A activity relying in large part on a continuing desirability for digital transformation and increased efficiency amongst enterprises across all industries. Particular interest in cybersecurity, data analytics, digital health, artificial intelligence, machine learning and cloud computing represent significant unrealized opportunities to drive rapid growth over short and long term time horizons.

- Healthcare: Continued consolidation ("roll-ups") of private clinics and practices, specialist care providers and healthcare services groups created and will continue to create M&A headwinds in the industry. Similarly, a consistent movement towards the digitization of health has placed pressure on enterprises to add on accretive services for future growth plans. Within the life sciences sector, the Canadian cannabis industry has begun to mature and force enterprises, distressed or otherwise, to combine to shore up balance sheets and/or gain market share. Relatedly, cannabis legal reform in the United States may invite additional M&A activity north of the border. Global attention on the psychedelics industry has created M&A activity as market participants look to divest non-core assets and/or combine with strategic competitors.

- Agribusiness and food: Owing to their relative counter cyclicality, the agribusiness and food industries continue to be of interest to private equity buyers as, in some cases, family owned enterprises seek to monetize long held assets. Global themes such as inflation and food security and scarcity continue to provide additional impetus for buyers to transact at consistent levels.

Trends to Watch in Canada in 2023

- Going private transactions: An uptick is expected from small, medium to large caps by financial, strategic and opportunistic buyers. This includes both domestic and foreign buyers of Canadian assets given the existence of undervalued deal targets across multiple industries, particularly technology.

- Private equity: PE interest in the mid-market will likely continue to abound with both local and foreign enterprises, as attractive assets remain available in the Canadian marketplace. Surplus funds remain on the sidelines to be mobilized, but we expect to see greater scrutiny of acquisition targets and longer completion timelines for transactions in 2023. We also expect to see continued activity in private equity secondary transactions following a relatively busy 2022.

- Shareholder activism: Shareholder activist campaigns increased in the second half of 2022 despite an overall decline year over year. Notwithstanding, shareholder proposals more than doubled from 2021 to 2022, suggesting a potential for more activism in 2023 as deal makers seek alternative means of unlocking value.

- Distressed M&A, restructuring and insolvency: It is widely expected that the Canadian marketplace is entering into a distressed cycle after the last few years and that distressed sales are expected to be an increased part of 2023 M&A activity. Increased opportunities for distressed assets are expected given the emergence of not only several highly volatile emerging industries, but other traditional industries now experiencing uncertain trajectories. We believe this uncertainty, among other variables, will provide greater distressed openings for prospective distressed investors in Canada in 2023, particularly in commercial real estate, retail and certain other emerging industries, including the cannabis and crypto industries.

Looking Ahead to 2023

It was no surprise that Canadian M&A deal activity was down from 2021's record year. Companies and investors were faced with a unique set of challenges in rapid succession in 2022—inflation, rising interest rates, Russia's invasion of Ukraine, a lack of stability in commodity prices, squeezed or shifting supply chains, capacity issues and the possibility of a recession. Regulators in the United States and Canada also continued to tighten their review processes in 2022 and more readily used their enforcement powers, resulting in deal delays and increased conditionality. Despite these challenges, 2022 was still a strong year for M&A in Canada as compared to historical periods.

Although these pressures will remain in 2023, we expect that M&A activity will be positive with some impressive activity in certain sectors including technology and software, battery metals in the mining sector, healthcare and agribusiness. Given that energy transformation in Canada is at a relatively early stage, it is well situated to attract interest from investors in 2023, particularly focused on biofuels, hydrogen and carbon capture, utilization and storage.

Bennett Jones' Mergers & Acquisitions practice spans all industries—particularly those that drive the Canadian economy. To discuss the developments and opportunities shaping the Canadian M&A landscape, please contact the authors.

Please note that this publication presents an overview of notable legal trends and related updates. It is intended for informational purposes and not as a replacement for detailed legal advice. If you need guidance tailored to your specific circumstances, please contact one of the authors to explore how we can help you navigate your legal needs.

For permission to republish this or any other publication, contact Amrita Kochhar at kochhara@bennettjones.com.