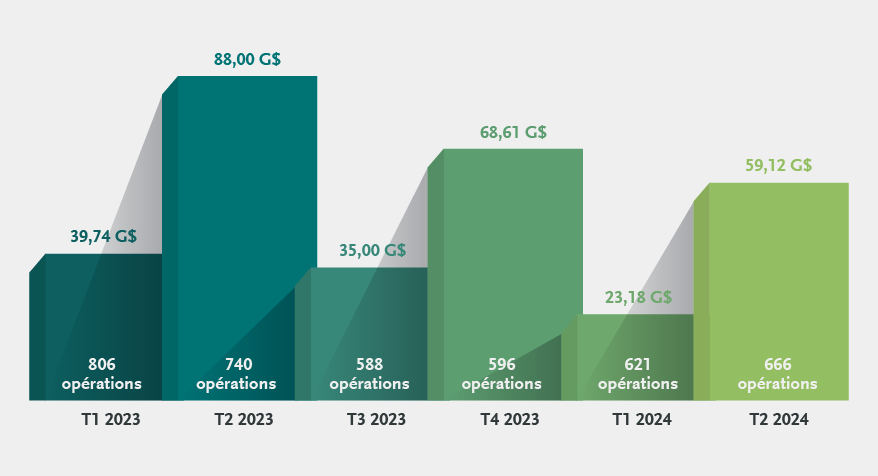

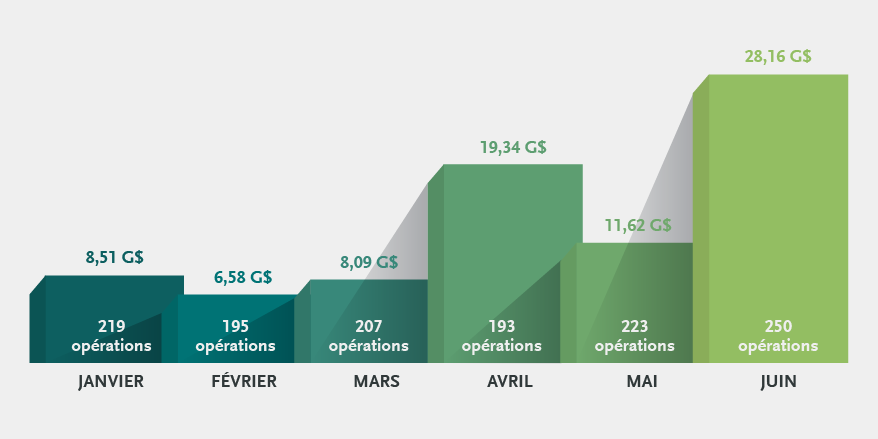

Actualités en F&A au Canada au T2 de 2024 : pleins feux sur le QuébecDans ce billet spécial de Bennett Jones sur l’actualité trimestrielle en fusions et acquisitions, nous examinons l’activité transactionnelle et le climat d’investissement au Canada, en mettant l’accent sur le marché québécois. Le deuxième trimestre de 2024 et l’année en général, jusqu’à maintenant, ont été marqués par d’importantes opérations, des investissements soutenus dans l’innovation pour la transition énergétique au Québec, une réduction des taux d’intérêt (taux qui ont été réduits davantage en juillet), des changements notables en matière fiscale et réglementaire, ainsi que des points positifs et des défis dans le domaine du capital-investissement et du capital de risque. Activité de F&A au T2 de 2024Les données indiquées se fondent sur les données de Bloomberg au 30 juin 2024, en dollars américains, sauf indication contraire (opérations annoncées, terminées ou en cours, à l’exception de celles qui ont été résiliées ou retirées, et pour lesquelles l’acquéreur, la cible ou le vendeur est une société canadienne). Le volume total des opérations de F&A au Canada a continué de progresser en dents de scie au deuxième trimestre de 2024. Sur le plan du volume trimestriel, le T2 de 2024 se classe au troisième rang depuis le début de 2023. On comptait 666 opérations ce trimestre, ce qui représente une hausse du nombre d’opérations pour un troisième trimestre d’affilée. Opérations de F&A au CanadaL’activité a augmenté globalement au T2, quelle que soit la taille de l’opération. C’est au mois de juin que l’activité a été la plus intense, tant sur le plan du volume que du nombre d’opérations. Activité mensuelle pour les opérations de F&A en 2024Des sociétés québécoises ont participé à deux opérations dans le secteur des services financiers pour une valeur totale approchant les 10 milliards de dollars. Une transformation en société fermée d’une société de technologie financière d’une valeur de 6,3 milliards de dollars, annoncée en avril, et une acquisition par la Banque Nationale du Canada, institution montréalaise, de la Banque canadienne de l’Ouest pour 3,66 milliards de dollars, annoncée le 11 juin. Le 24 juin, la CDPQ et TPG, une société de capital-investissement, ont annoncé qu’elles acquerront Aareon, un fournisseur européen de solutions logiciels-services (SaaS) dans le secteur immobilier, auprès d’Aareal Bank et d’Advent International pour la somme de 4,18 milliards de dollars. Plus tôt ce mois-ci, la CDPQ a vendu sa participation dans l’aéroport de Budapest pour 3,37 milliards de dollars. Dans le secteur minier, la quatrième opération en importance visait l’acquisition de gisements d’uranium au Québec. La cinquième opération en importance visait la fusion de deux sociétés aurifères québécoises. Bien que les dernières données indiquent que les activités de F&A au Canada étaient inégales au T2 de 2024, avec des hauts et des bas mensuels sur les plans de la valeur et du nombre d’opérations, le trimestre inscrit une croissance solide à ces deux chapitres par rapport au T1 de 2024. L’importance de certaines opérations dans les secteurs des services financiers, de l’énergie, des technologies, des soins de santé et des mines témoigne d’une certaine vigueur sectorielle. On peut donc s’attendre à ce que le marché des F&A maintienne son dynamisme au pays, surtout au Québec. Investissements dans le secteur québécois des VÉLe Québec s’impose de plus en plus comme un chef de file nord-américain de l’innovation dans la transition énergétique. En effet, la province travaille à établir un complexe de production de batteries pour véhicules électriques (VÉ) par des investissements dans un écosystème devant soutenir les projets d’extraction et de transformation de minerais essentiels, de traitement électrochimique, d’électrification des transports et de décarbonation. Le régime avant-gardiste d’incitatifs fiscaux du Québec et le soutien stratégique des investisseurs institutionnels québécois et fédéraux dans le cadre de projets majeurs de dépenses en immobilisations ouvrent la voie aux investissements et positionnent la province comme destination de choix, notamment pour les sociétés minières et d’autres fournisseurs de la chaîne d’approvisionnement des batteries de VÉ. Le Québec a attiré une somme record de 13 milliards de dollars canadiens en investissement direct étranger pour l’exercice se terminant le 31 mars, selon Investissement Québec. C’est plus du double par rapport au record enregistré à l’exercice précédent, soit 6 milliards de dollars canadiens. Cette montée en flèche de l’investissement étranger est principalement attribuable à la suédoise Northvolt, qui a annoncé la construction d’une méga-usine de batteries dans l’Est de Montréal, au coût de 7 milliards de dollars canadiens. Des sociétés américaines et sud-coréennes ont également annoncé des milliards de dollars en investissements supplémentaires dans la chaîne de fabrication québécoise de VÉ. Nouvelle réglementationTaux d’intérêtLe 5 juin 2024, la Banque du Canada a baissé son taux directeur de 25 points de base pour l’établir à 4,75 %. Il s’agit de la première réduction de taux en quatre ans. La Banque a ensuite baissé le taux directeur à 4,5 % le 24 juillet. Les auteurs des Perspectives économiques de mi-exercice 2024 de Bennett Jones, sous la direction de l’ancien gouverneur de la Banque du Canada, David Dodge, s’attendent à une ou deux autres réductions de 25 points de base avant la fin de l’année. La Réserve fédérale américaine devrait réduire ses taux une fois, d’un quart de point de pourcentage, d’ici la fin de l’année. Selon les scénarios présentés dans les Perspectives, les taux directeurs des deux économies ne seront pas réduits au même rythme, mais devraient néanmoins atteindre le plancher de 3,0 % au début de 2026. On prévoit que l’inflation atteigne la cible de 2 % à la fin de 2025 au Canada et au début de 2026 aux États-Unis. Taux d’inclusion des gains en capitalLe budget fédéral de 2024 a fait passer de 50 % à 66⅔ % le taux d’inclusion applicable à la portion des gains en capital réalisés au cours de l’année dépassant 250 000 $ pour les particuliers et à l’ensemble des gains en capital réalisés par les sociétés et les fiducies en cours d’année, la mesure prenant effet le 25 juin 2024. Selon le gouvernement, cette mesure accroît l’équité fiscale et ne touche qu’un petit nombre de contribuables. Une bonne partie du milieu des affaires affirme que les investissements en souffriront. On verra avec le temps les effets de la mesure sur les activités de F&A au pays. Le secteur minier et le projet de loi 63Le Québec se démarque au pays par son soutien à l’activité minière, comme en témoignent son cadre réglementaire accommodant et ses incitatifs fiscaux. Les autorités provinciales mettent surtout l’accent sur les minerais essentiels et ont mis en place un régime d’incitatifs avant-gardiste pour inciter l’investissement dans le secteur. Le projet de loi no 63, Loi modifiant la Loi sur les mines et d’autres dispositions, annoncé le 27 mai 2024, témoigne de l’engagement du Québec à actualiser les lois régissant le secteur minier pour les aligner sur ses objectifs à long terme en matière d’environnement et de durabilité. Il est crucial que la province conserve son cadre réglementaire actuel, notamment les incitatifs fiscaux à l’investissement dans les minerais essentiels, et mette l’accent sur son engagement à long terme à s’imposer comme chef de file du secteur minier. Capital de développement et capital de risque au QuébecRéseau Capital a publié, le 17 mai, son aperçu du marché québécois du capital de risque (CR) et du capital de développement (CD) pour le T1 de 2024. On y fait état de divers points positifs et de quelques obstacles tenaces concernant les investissements. Autant pour le CR que le CD, la valeur des investissements a augmenté au premier trimestre, tandis que le nombre des opérations reculait. À l’échelle canadienne, le Québec accaparait 23 % des opérations au T1 et 45 % des investissements en CR. La taille moyenne des investissements en CR au Québec s’élève à 20,09 millions de dollars, la plus haute au pays. À l’échelle canadienne, le Québec accaparait 55 % des investissements en capital de développement et 73 % des investissements. La taille moyenne des investissements en CD s’établissait à 38 millions de dollars, un sommet depuis 2019. Selon Réseau Capital, les investissements en CR et en CD ont souffert de l’inflation, de la situation économique et géopolitique mondiale et de la diminution de la confiance des consommateurs. Regard vers l’avenirDe nouvelles opérations de grande valeur dans des secteurs piliers laissent entrevoir une activité vigoureuse pour le reste de 2024. Les acteurs devraient garder l’œil ouvert pour saisir les occasions, profiter des tendances sectorielles et tirer parti de l’amélioration du marché et des conditions économiques. Les préférences à l’égard des produits de base peuvent varier, mais le potentiel géologique du Québec et un environnement réglementaire favorable peuvent séduire les investisseurs étrangers, ce qui soutiendra la croissance dans le secteur minier. Les perspectives sont donc positives pour le secteur minier québécois. Les fusions et acquisitions chez Bennett JonesLe groupe Fusions et acquisitions de Bennett Jones touche à tous les secteurs, surtout ceux qui forment le moteur économique du Québec et du Canada. Pour en savoir plus sur les actualités et les occasions sur le marché des F&A, communiquez avec les auteurs. Auteur(e)s

Veuillez noter que cette publication présente un aperçu des tendances juridiques notables et des mises à jour connexes. Elle est fournie à titre informatif seulement et ne saurait remplacer un conseil juridique personnalisé. Si vous avez besoin de conseils adaptés à votre propre situation, veuillez communiquer avec l’un des auteurs pour savoir comment nous pouvons vous aider à gérer vos besoins juridiques. Pour obtenir l’autorisation de republier la présente publication ou toute autre publication, veuillez communiquer avec Amrita Kochhar à kochhara@bennettjones.com. |

S’abonner

Restez au fait des dernières nouvelles et de nos événements dans le domaine des affaires et du droit.

Blogue